Hello folks,

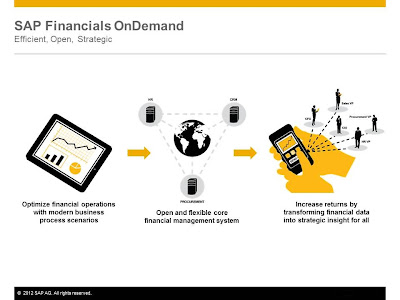

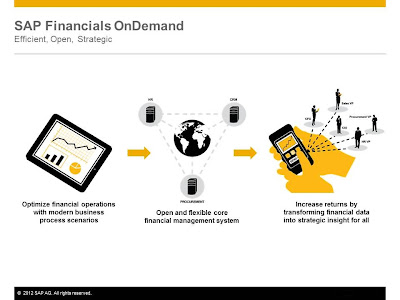

Maybe you have heard that we are just about to launch an exciting new member of the SAP Cloud family at SAPPHIRE NOW in Madrid in November. As we gear up for this launch, I am writing a series of blogs to formulate my thoughts about the solution. Today I'd like to give you all a basic primer on what SAP Financials OnDemand is all about.

I think the first thing to address is the role of a modern finance department and what issues and challenges they face today that prompted us to develop a brand new solution for this space.

Some of you might think that the area of finance has been around for such a long time that the processes of basic accounting, reporting, controlling should be well under control. Why should there be such an urgent need for renovation? Here is why. Research has shown, that most finance departments would like to move away from being purely operational to becoming more strategic. CFO's are being tasked to become more of a driver for sustainable and profitable growth for the entire enterprise. The reality today is, however, that most finance professionals are actually "stuck in reporting hell". Instead of rapidly analyzing information and providing insight to executive management for real time action, teams of highly trained professionals spend much of their time in data consolidation, aggregation and, often, redundant corrective action based on the fragmentation of systems and general ledgers that has accumulated over the past decades. This is the reason why we felt the time was ripe to develop a new Financials Engine that can drastically transform this area.

Let me give you one example where we can really help with this new solution: Many large companies have systems with potentially 1000's of general ledger accounts. For example, enterprise would typically have a General Ledger account for meals and entertainment that gets replicated for each department, and sometimes even at the project level. This large and proliferating number of accounts is unwieldy, hard to report against, and frankly not agile enough to deal with today's demand for a modern financials department. Another problem is the common software development practice of using a so-called "coding block" to embed meaning within a string of numbers such as 09092000307652. In this case the first three digits 090 could mean company code, then a department code 920, then an expense type 0003, etc. This deep meaning embedded in a string of numbers was invented at a time when memory was scarce, storage was at a premium and financial systems were built for experts. This "hangover" from older system architectures persist today and can make financial systems very hard to change.

So how are we addressing these issues (among a ton of other things which I will cover in later blogs) with SAP Financials OnDemand?

Above all, SAP Financials OnDemand is based on an innovate In-Memory architecture using SAP HANA. SAP HANA is a completely new way to extremely rapidly store and retrieve information in it's rich, native format using a flexible approach to reflect multiple real-world attributes and business dimensions. Using SAP HANA powering SAP Financials OnDemand, enterprises can drastically increase the flexibility in which they store and retrieve general ledger entries, giving them virtually unlimited flexibility to report on any business dimension they chose. The idea is to enable enterprises to get out of the game of generating a scattered landscape of many many specific-purpose and potentially rigid general ledgers. The idea is to minimize, if not completely doing away with time consuming and complex reconciliation! With SAP Financials OnDemand enterprises can fundamentally simplify the task of creating a single source of truth that is not only much more flexible, but also drastically easier to use and more relevant for everyone in the enterprise.

Are you bored yet? I would not blame you since this stuff is usually reserved for experts. Let's bring it back to the end user level, to average Jane and Joe, if you will. Most of you are probably working in jobs where you would like to have accurate real-time information ready at your fingertips any time and anywhere. But you still don't have that. How come?

Isn't it true that there are great analytical and business intelligence tools out there? Yes!

Isn't it true that there are data warehouses, and data marts that provide multi-dimensional reporting for anyone in the enterprise? Yes and Yes! There has been tremendous progress over the last 40 years to get data out of systems and to aggregate them, enrich them and deliver the information to a great set of tools.

But ...

What's important is that the transactional systems that are the source for these business intelligence tools are mainly intended to run todays's billion € a second globally connected economy. THEY WERE BUILT FOR TRANSACTIONS. And these systems will stay in place. They will continue to be enhanced. And they will continue to feed the "Analytics Farms" and Business Intelligence engines that feed decision making today.

But what about brand new systems for new companies, new divisions, new joint ventures and new projects? Should we go accept the limitations of pure transactional systems, the limitations of rigid coding blocks, the limitations of the need for aggregation, the limitations of separate reporting systems? I don't think so. And there is no need to do so any longer.

But what about brand new systems for new companies, new divisions, new joint ventures and new projects? Should we go accept the limitations of pure transactional systems, the limitations of rigid coding blocks, the limitations of the need for aggregation, the limitations of separate reporting systems? I don't think so. And there is no need to do so any longer.

With SAP Financials OnDemand you will get a system that is built on 40 years of experience with providing the heavy lifting needed to power financial transactions for the global economy. But SAP Financials OnDemand was not built around just transactions, compliance and reporting. It was build around the concept of a single, trusted source of truth that can be the foundation for insight and collaboration for everyone in your enterprise.

It think this basic value proposition is captured fairly well in the following short video clip produced by the team gearing up for the launch.

http://www.youtube.com/watch?v=RQL2dyiqCqE&feature=youtu.be

I hope this short blog has given you a bit of perspective of what we are trying to do with SAP Financials OnDemand. I look forward to your questions and comments

CHHO, Vierkirchen, Oct. 5, 2012

Maybe you have heard that we are just about to launch an exciting new member of the SAP Cloud family at SAPPHIRE NOW in Madrid in November. As we gear up for this launch, I am writing a series of blogs to formulate my thoughts about the solution. Today I'd like to give you all a basic primer on what SAP Financials OnDemand is all about.

I think the first thing to address is the role of a modern finance department and what issues and challenges they face today that prompted us to develop a brand new solution for this space.

Some of you might think that the area of finance has been around for such a long time that the processes of basic accounting, reporting, controlling should be well under control. Why should there be such an urgent need for renovation? Here is why. Research has shown, that most finance departments would like to move away from being purely operational to becoming more strategic. CFO's are being tasked to become more of a driver for sustainable and profitable growth for the entire enterprise. The reality today is, however, that most finance professionals are actually "stuck in reporting hell". Instead of rapidly analyzing information and providing insight to executive management for real time action, teams of highly trained professionals spend much of their time in data consolidation, aggregation and, often, redundant corrective action based on the fragmentation of systems and general ledgers that has accumulated over the past decades. This is the reason why we felt the time was ripe to develop a new Financials Engine that can drastically transform this area.

Let me give you one example where we can really help with this new solution: Many large companies have systems with potentially 1000's of general ledger accounts. For example, enterprise would typically have a General Ledger account for meals and entertainment that gets replicated for each department, and sometimes even at the project level. This large and proliferating number of accounts is unwieldy, hard to report against, and frankly not agile enough to deal with today's demand for a modern financials department. Another problem is the common software development practice of using a so-called "coding block" to embed meaning within a string of numbers such as 09092000307652. In this case the first three digits 090 could mean company code, then a department code 920, then an expense type 0003, etc. This deep meaning embedded in a string of numbers was invented at a time when memory was scarce, storage was at a premium and financial systems were built for experts. This "hangover" from older system architectures persist today and can make financial systems very hard to change.

So how are we addressing these issues (among a ton of other things which I will cover in later blogs) with SAP Financials OnDemand?

Above all, SAP Financials OnDemand is based on an innovate In-Memory architecture using SAP HANA. SAP HANA is a completely new way to extremely rapidly store and retrieve information in it's rich, native format using a flexible approach to reflect multiple real-world attributes and business dimensions. Using SAP HANA powering SAP Financials OnDemand, enterprises can drastically increase the flexibility in which they store and retrieve general ledger entries, giving them virtually unlimited flexibility to report on any business dimension they chose. The idea is to enable enterprises to get out of the game of generating a scattered landscape of many many specific-purpose and potentially rigid general ledgers. The idea is to minimize, if not completely doing away with time consuming and complex reconciliation! With SAP Financials OnDemand enterprises can fundamentally simplify the task of creating a single source of truth that is not only much more flexible, but also drastically easier to use and more relevant for everyone in the enterprise.

Are you bored yet? I would not blame you since this stuff is usually reserved for experts. Let's bring it back to the end user level, to average Jane and Joe, if you will. Most of you are probably working in jobs where you would like to have accurate real-time information ready at your fingertips any time and anywhere. But you still don't have that. How come?

Isn't it true that there are great analytical and business intelligence tools out there? Yes!

Isn't it true that there are data warehouses, and data marts that provide multi-dimensional reporting for anyone in the enterprise? Yes and Yes! There has been tremendous progress over the last 40 years to get data out of systems and to aggregate them, enrich them and deliver the information to a great set of tools.

But ...

What's important is that the transactional systems that are the source for these business intelligence tools are mainly intended to run todays's billion € a second globally connected economy. THEY WERE BUILT FOR TRANSACTIONS. And these systems will stay in place. They will continue to be enhanced. And they will continue to feed the "Analytics Farms" and Business Intelligence engines that feed decision making today.

But what about brand new systems for new companies, new divisions, new joint ventures and new projects? Should we go accept the limitations of pure transactional systems, the limitations of rigid coding blocks, the limitations of the need for aggregation, the limitations of separate reporting systems? I don't think so. And there is no need to do so any longer.

But what about brand new systems for new companies, new divisions, new joint ventures and new projects? Should we go accept the limitations of pure transactional systems, the limitations of rigid coding blocks, the limitations of the need for aggregation, the limitations of separate reporting systems? I don't think so. And there is no need to do so any longer.With SAP Financials OnDemand you will get a system that is built on 40 years of experience with providing the heavy lifting needed to power financial transactions for the global economy. But SAP Financials OnDemand was not built around just transactions, compliance and reporting. It was build around the concept of a single, trusted source of truth that can be the foundation for insight and collaboration for everyone in your enterprise.

It think this basic value proposition is captured fairly well in the following short video clip produced by the team gearing up for the launch.

http://www.youtube.com/watch?v=RQL2dyiqCqE&feature=youtu.be

I hope this short blog has given you a bit of perspective of what we are trying to do with SAP Financials OnDemand. I look forward to your questions and comments

CHHO, Vierkirchen, Oct. 5, 2012